US-AU DTA: Article 4 – Residence

GENERAL BACKGROUND In this week’s blog, we will be discussing Article 4 of the DTA (Residence), with a specific focus on its applicability... Read more

Investing in Private Aviation with Lisa Senters

In the second episode of the Wealth Management series, Peter Harper interviews Lisa Senters on Private Aviation and how you can go about... Read more

Investing in French Real Estate with Delphine Belin

In our first episode of the 3 Pillars Podcast: Wealth Management Series, special guest Delphine Belin and host Peter Harper discuss investing and... Read more

US-AU DTA: Article 3 – General Definitions

GENERAL BACKGROUND Last week we discussed the taxes covered by the DTA as set out in Article 2. In this week’s blog, we will... Read more

US-AU DTA: Article 2 – Taxes Covered

GENERAL BACKGROUND Last week we discussed the scope and limitations of the DTA as set out in Article 1. In this week’s blog,... Read more

US-AU DTA: Article 1 – Personal Scope

GENERAL BACKGROUND In this series, we will be discussing the Convention Between the Government of the United States of America and the Government... Read more

Remediation for Cryptocurrency

GENERAL BACKGROUND As briefly mentioned in our blog last week, the Green Book offers new details on the various proposals included in the... Read more

President Biden’s Green Book: Deductions for On & Offshoring Corporations

Sub Part F of the Green Book Budget GENERAL BACKGROUND Given the global pandemic and the economic stress experienced by governments due to... Read more

Grantor Trust

What Is A Grantor Trust? According to the IRS, a grantor trust is one in which the grantor, i.e. the settlor establishing the... Read more

Net Investment Income Tax (NIIT)

GENERAL BACKGROUND Last week, we wrapped up our series on Entity Classification. If you have not read it yet, or would like to... Read more

Entity Classification Series: What Is A Change In Classification?

GENERAL BACKGROUND Last week we discussed what exactly an initial election is under the Check the Box regulations. We barely touched on what... Read more

Entity Classification Series: What Is An Initial Classification Election?

GENERAL BACKGROUND As you have probably realized in this Entity Classification series, any question put to the reader in the weekly blog does... Read more

Entity Classification Series: Converting a Corporation to a Partnership

GENERAL BACKGROUND Following on from last week’s blog regarding the “Conversion of a Multi Member LLC to a Corporation”, it is probably an... Read more

Entity Classification Series: Converting Multi Member LLC to Corporation

GENERAL BACKGROUND Last week we discussed the conversion of a Single Member LLC to a Corporation. In this week’s blog we will discuss... Read more

Entity Classification Series: Converting a Single Member LLC to a Corporation

GENERAL BACKGROUND In this week’s blog we will look at the US Federal Tax Implications of converting a Single Member Limited Liability Corporation... Read more

Entity Classification Series: What Is An Ordinary Trust And Is Your Entity One?

GENERAL BACKGROUND We discussed in our previous blog what constitutes a “business trust” for Federal Tax Purposes. In this week’s blog we will... Read more

Entity Classification Series: What is a Business Trust and Is Your Entity One?

GENERAL BACKGROUND Trusts are one the most popular investment and business vehicles used worldwide. It provides various benefits and planning opportunities for families... Read more

Entity Classification Series: Pick Your Own Path – Are You Eligible?

GENERAL BACKGROUND As discussed in our previous blog – “Entity Classification Series: Corporate Taxation vs Passthrough - What is the Difference?” The United... Read more

Entity Classification Series: Corporate Taxation vs Passthrough – What is the Difference?

GENERAL BACKGROUND The United States (US) taxes business entities based on how they are classified for income tax purposes. There are distinct differences... Read more

IRC Section 679 – When is a Trust a Foreign Grantor Trust?

In our last installment of the Grantor Trust Series, Peter Harper, Asena's managing director and CEO, explains IRC Section 679, addressing foreign trusts,... Read more

IRC Section 678 – Someone Other Than the Grantor is the Owner of Trust

In our 8th installment of the grantor trust series, Peter Harper, our managing director and CEO, explains IRC Section 678 and the circumstances... Read more

IRC Section 677 – When A Right to Income Makes a Trust a Grantor Trust

In this week's vlog, the managing director and CEO of Asena Advisors, Peter Harper examines Section 677 of the Internal Revenue Code: the Grantor... Read more

IRC Section 676 – How a Power of Revocation Makes a Trust a Grantor Trust

In the 6th installment of our Grantor Trust Series, Peter Harper, managing director and CEO of Asena Advisors, discusses Section 676 of the... Read more

IRC Section 675 – Do Your Trust Powers Make a Foreign Trust a Grantor Trust?

In this week’s vlog, the managing director and CEO of Asena Advisors, Peter Harper, discusses Section 675 of the Internal Revenue Code and... Read more

IRC Section 674 – Does Your Trustee Make Your Trust a Grantor Trust?

In this week's vlog, Peter Harper - the managing director and CEO of Asena Advisors - discusses Section 674 of the Internal Revenue... Read more

IRC Section 673 – Does the Grantor of Your Trust Have a Reversionary Interest?

In this installation, Peter Harper, the managing director and CEO of Asena Advisors discusses qualifications of a grantor trust and whether or not... Read more

Do you own a Foreign Grantor Trust? How It Impacts an Investment or Liquidity Event.

In this week's vlog, our Managing Director and CEO, Peter Harper, talks about discretionary trusts, how they can be classified as foreign grantor trusts... Read more

Grantor Trust Rules – A Primer

In this week’s vlog, Peter Harper, our Managing Director and CEO, discusses grantor trusts and how the grantor trust rules apply to US... Read more

Why 2021 is not 2020

In this week's vlog, Peter Harper, our Managing Director & CEO, discusses what makes this upcoming year different than last year. Both economically... Read more

When Should Australian Investors Focus on the US?

In this vlog, Peter Harper, our CEO and managing director, discusses the plans for the New Year and how to prepare fiscally for... Read more

Happy Holidays from the Team at Asena!

Thank you for the confidence and trust you have placed in us to advise you on your Australian and US tax matters in 2020.... Read more

Estate Planning and Cross Border Issues Seminar

We were delighted to have been invited to present a seminar on cross-border issues in estate planning for the Leo Cussen Institute recently. Renuka Somers... Read more

What’s a GRAT? Should you have one?

A “Grantor Retained Annuity Trust”, more commonly known as a “GRAT”, is an irrevocable trust that can reduce estate tax exposure. GRATs are usually... Read more

Happy Thanksgiving From the Team at Asena

On Thursday we celebrate Thanksgiving Day, an annual national holiday in the United States since 1863 that pays tribute to the harvest and... Read more

Mergers & Acquisitions: Interposing an Australian Holding Company – Part 3: the US Anti-Inversion Rules

*The concepts discussed in this blog are complex and require careful consideration to ensure compliance with Australian and US tax laws. Unless otherwise... Read more

How Does the Biden Tax Plan Affect US-Australians?

Today, we consider and summarize how President-elect Joe Biden's tax plan can affect US-Australians. The plan is detailed at https://joebiden.com/two-tax-policies/. Some of the key features... Read more

Mergers & Acquisitions: Interposing an Australian Holding Company – Part 2: the US Corporate Reorganization Rules

* The concepts discussed in this blog are complex and require careful consideration to ensure compliance with Australian and US tax laws. Unless... Read more

Mergers & Acquisitions: Interposing an Australian Holding Company – Part 1: Scrip for Scrip in a Cross-Border Context

* The concepts discussed in this blog are complex and require careful consideration to ensure compliance with Australian and US tax laws. Unless... Read more

International Estate Planning: Which US States Have Ratified the “International Will Treaty”?

Between October 16th and 26th of 1973, Washington D.C. held the Diplomatic Convention on Wills to discuss providing a uniform law on the... Read more

The 3 Pillars Podcast: Wealth Education: ‘Philanthropy or Legacy: How to Build Purpose in the Next Gen’

In the eighth episode of the 3 Pillars Podcast, Peter Harper and Andrew Doust discuss wealth education and how establishing personal, family, and... Read more

The 3 Pillars Podcast: Wealth Management – A Liquidity Event is Just an Acceleration of Cashflow

In this week's episode, our two special guests - Mr. Joshua Luff and Mr. Alex Thompson - discuss liquidity events, cash flow, and... Read more

Non-Residents of Australia and SMSFs

Today's blog is an alert on an issue that we are increasingly seeing in practice. Australians love real estate and running their own... Read more

The 3 Pillars Podcast: Administration – People are More Successful and Happy With Good Support

In the sixth installment of the 3 Pillars Podcast, we're switching it up! This week, returning guest Thor Conklin will interview our managing... Read more

LLC Series: The US and Australian Tax Implications of Selling an LLC Interest vs Selling Stock in a US Corporation

How should an Australian resident investor hold their interest in a business that has a high potential for capital growth? How you structure... Read more

The 3 Pillars Podcast: The Legal Rule Book and the Role of the Fiduciary

In the fifth installment of the 3 Pillars Podcast, the Managing Director and CEO of Asena Advisors - Peter Harper, and this week's... Read more

Justice Ruth Bader Ginsburg and the Legacy of Perseverance

On September 18th, 2020, US Supreme Court Justice Ruth Bader Ginsburg passed away in her D.C. home due to metastatic pancreas cancer. At... Read more

The 3 Pillars Podcast: How Do you Protect the Downside? – Building a Family Bank

In the fourth installment of the 3 Pillars Podcast, Peter Harper, the Managing Director and CEO of Asena Advisors and special guest Mike... Read more

LLC Series: The US and Australian Tax Effect of Holding Membership Interests in an LLC vs Stock in a US Corporation

How should an Australian resident investor hold their interest in a business that has high turnover and potential for significant income distributions? What... Read more

The 3 Pillars Podcast: Tax – How does a Liquidity Event Change the Risk Profile of a Taxpayer?

In the third installment of the 3 Pillars Podcast, Peter Harper, our Managing Director and CEO discusses with a special guest the value... Read more

International Estate Planning: Estate Structuring for Australians who are US Citizens or Green Card Holders

Consider this scenario: You and your spouse are Australians with US citizenship or green cards, and intend to live in the US indefinitely.... Read more

The 3 Pillars Podcast: Accountability – You Get What You Measure

In the second installment of Asena Advisors' new podcast, our Managing Director and CEO: Peter Harper discusses with a special guest the value... Read more

Capital Gains and Non-Resident Beneficiaries: It’s Bad News Again as Martin Holdings Confirms Greensill

On August 18th, 2020, the Federal Court of Australia handed down its decision in N & M Martin Holdings Pty Ltd v Commissioner... Read more

The 3 Pillars Podcast: Values – What are your Family Values and Why are They Important?

Asena Advisors is launching “The 3 Pillars Podcast”, where our Managing Director and CEO Peter Harper discusses with a special guest the value... Read more

Structuring Australian Inheritances for US Citizens and Green Card Holders – Testator Considerations

How should your estate be structured if one of your children lives in the US and intends to do so indefinitely? This is an... Read more

LLC Series: Selling or Converting an LLC interest – the Australian Tax Implications: Hybrid Entities, Subdivision 122-B, and the Impact of Burton

For Australian tax purposes, an LLC is a “foreign hybrid company” and treated as a partnership for Australian tax purposes if it satisfies... Read more

LLC Series: Selling or Converting an LLC Interest – the US Tax Implications: Partnerships, “Effectively Connected Income” and the US Non-Recognition Rules

An LLC is a popular entity for Australians investing, or carrying on business, in the US. What happens if your business has matured... Read more

LLC Australia

LLC Australia With ties and clients in Australia, we here at Asena Family Office often get questions about how to set up an... Read more

LLC Series: LLCs – US and Australian Classification and Tax Considerations

An LLC, also known as a Limited Liability Company, is a form of a private limited company specific to the US, which combines... Read more

Selling Your Business is An Acceleration of Cashflow – Are You Prepared?

In this vlog, Peter Harper, our CEO and managing director discusses a topic that is a core focus of our multi-family clients –... Read more

Mergers & Acquisitions: “Restructuring” and Demergers: The ATO finalizes its position in TD 2020/6

The ATO has finalized its position on "restructuring" in demergers overnight, with the release of Taxation Determination TD 2020/6 confirming its position in... Read more

Take a breath!

This week we are taking a break from our usual technical tax blogs, to pause and breathe. It seems we need this now, more... Read more

Double Taxation and invoking the Mutual Agreement Procedure

What is the Mutual Agreement Procedure? As our economy globalizes, it is common today for individuals and families residing around the world to... Read more

Time to Right Size Your Business and Family Expenditure!

In this vlog, Peter Harper, our CEO and managing director, discusses a topic that is a core focus of our clients in the... Read more

Does the US Net Investment Income Tax apply to you?

The NIIT is a 3.8% tax that is applied on certain investment income, effective from January 1, 2013, and was brought into effect... Read more

Cashflow Will Support a Strong Recovery – Are You Prepared?

In this vlog, Peter Harper, our CEO and managing director, explains how focusing on managing your cashflow, operating expenses and understanding risk adjusted... Read more

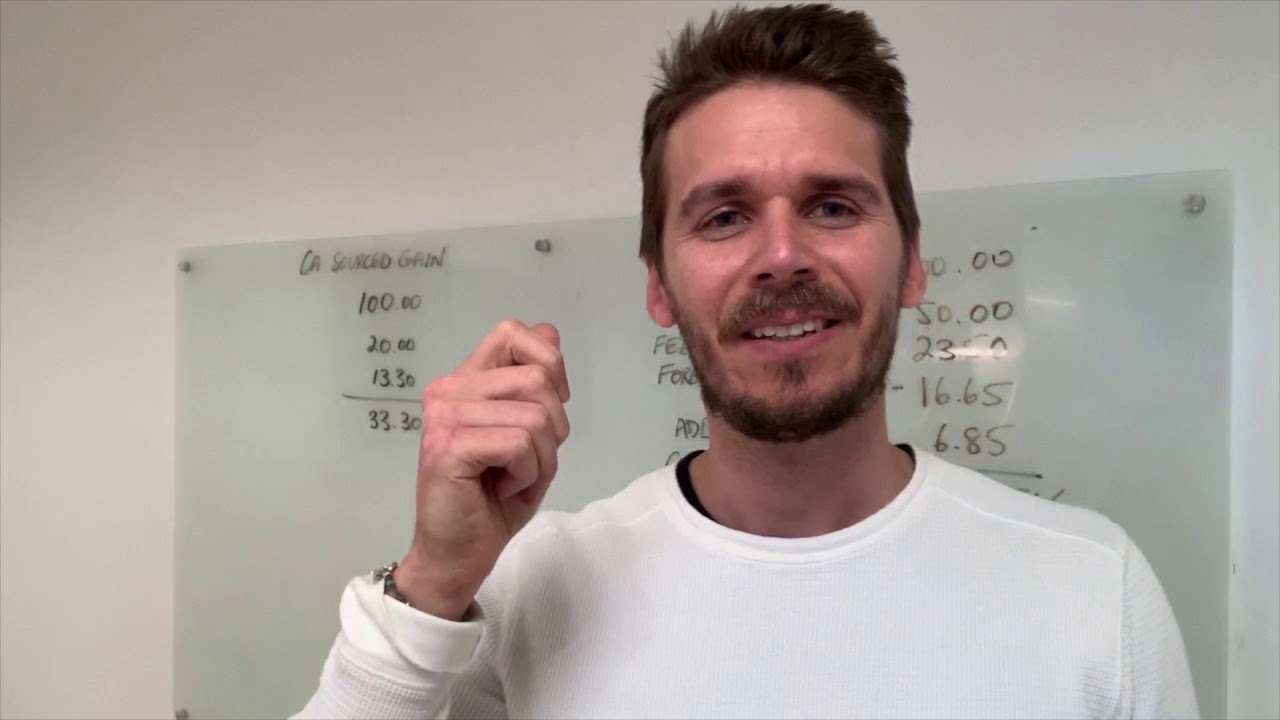

End of Financial Year Review: Foreign Sourced Capital Gains in Australian Trusts

. In this vlog, Peter Harper, our CEO and managing director, discusses two key cases (Burton V. Commissioner of Taxation & Peter Greensill... Read more

Digesting Alphabet Soup: How Should Investors Navigate The Recovery?

Many investors have been left baffled over the last few weeks, as seemingly negative news caused by the COVID crisis has somehow pushed... Read more

Understanding the US approach to reopening the economy

In this video, Peter Harper, our CEO and managing director, explains how the US constitutional framework affects the manner in which the US... Read more

Structuring Cross Border transactions- Part 2

Structuring Cross Border Transactions- Part 2 Read Now Read more

Capital Gains and Non-resident Beneficiaries – Trustee deemed assessable: Greensill confirms the ATO’s position

Capital gains and non-resident beneficiaries - trustee deemed assessable: Greensill confirms the ATO's position This week's Federal Court decision in Peter Greensill Family Co Pty Ltd (trustee) v... Read more

Let’s all try to be a little more like MJ!

Time for everyone to forget about when you are going to get back to normal, and be a little more like Michael Jordan.... Read more

Cross-border tax announcements on residency and PE determination by the U.S. IRS amid COVID-19 emergency

COVID-19 emergency has lead governments to close their borders and apply travel restrictions. Governments and international organization, like Organisation for Economic Co-operation and... Read more

Are You Preparing to Sell or Restructure A US Asset? Now Is the Time To Act!

Our U.S-Australia Tax desk recently published a paper in the Tax Institute's Blue journal (Structuring cross-border transactions- Part 1) discussing the draft Tax... Read more

Psychology of Crisis Recovery

In his last vlog, Peter Harper, our CEO and managing director, discussed some of the relief programs by the SBA in relation to... Read more

OECD addresses recommendations concerning creation of permanent establishments, place of effective management and cross-border workers amid COVID-19

On 3 April 2020, the Organization of Economic Cooperation and Development (OECD) Secretariat at the request of concerned countries has published an analysis... Read more

Myths Busted! Non Immigrant Visa Holders Can Access Small Business Relief in US!

There has been much confusion whether small businesses own by non-immigrant visa holders have access to the disaster relief program or the payroll... Read more

Be Vulnerable – People Love to Buy, But Hate To Be Sold!

In one of our previous vlogs, Peter Harper, our CEO and managing director discussed the four stages of the psychological impact of epidemics.... Read more

Aussies in America: Estate Planning Essentials

An interview by The Australian Community, a 501 C-3 public charity, with Peter Harper, our CEO and managing director, and Renuka Somers, our... Read more

How to Access the US Stimulus for Small Business and Why You Need to be Patient!

In this vlog, Peter Harper, our CEO and managing director, discusses how and when small businesses will be able to access the... Read more

Subsequent modifications to Indian tax residency rules

In view of the outbreak of COVID-19 pandemic, the Finance Minister of India presented several statutory and regulatory relief measures last week. One... Read more

Sail your business through COVID-19 with the right attitude

COVID-19 pandemic is expected to be infect close to 30% of the Americans with 0.5% mortality rate, if immediate testing and medical facilities... Read more

Take a breath – your business plan is ok!

In this vlog, Peter Harper, CEO of Asena Advisors, asks entrepreneurs to look at their business plans and consider how the current crisis... Read more

Equity markets are pricing in a worse than average US recession. The VIX is at 80. Have we seen the worst?

Look at history - present volatility suggests peak panic will create a bottom in stock prices. VIX peaked in October 2008. S&P500 price... Read more

The Ground is Moving – Focus on What You Can Control!

There are 4 stages to the psychological impact of epidemics. As entrepreneurs we need to push the dialogue from panic and fear... Read more

Opportunities amidst the chaos: protecting your family and your business

People becoming ill, a falling stock market, borders being closed, businesses being shut or operating on a lower capacity, business valuations declining, lower... Read more

CPA’s and the importance of an advisor-led relationship.

For our third vlog, Peter Harper, CEO and managing director of Asena Advisors, discusses the importance of choosing a CPA that has... Read more

Indian entities and U.S. taxation: Controlled foreign corporations and its ownership by a U.S. shareholder

Our whitepaper, The Interaction of Indian and U.S. Tax Laws addresses how the foreign corporations are treated as controlled foreign corporations (CFCs), and... Read more

How to choose a U.S CPA…The importance of hyper-specialization.

Choosing a CPA that is specialized in terms of the services it offers, geographical base and client persona is the key to... Read more

Top 4 Tips for choosing a CPA advisor

To kick of the upcoming tax season, we are excited to introduce Peter Harper our CEO and managing director. For his first... Read more

Top 2 tips for assessing a fee estimate

Continuing from his last vlog on choosing a CPA firm Peter Harper, our CEO, gives his top 2 tips to assess a... Read more

Time to review your structure: Foreign tax credits cut in half!

Burton v Commissioner of Taxations (2019) FCAFC 141 was the biggest tax case to impact U.S Australian tax in 15 years. It... Read more

The Importance of Being Defensive. How to Protect your Wealth in a Recession!

Peter Harper, our managing director and CEO, discusses the importance of being defensive and protecting your wealth in a declining market. [banner_3] Read more

Woodpoint Letter (Q1 2020): Correction or recession?

Market volatility reminds investors to understand risk In our last investment letter, we examined the macro environment moving into 2020 and discussed key... Read more

Indian entities and U.S. taxation: Controlled foreign corporations – defining key terms

In 1960s the concept of controlled foreign corporation (CFC) was introduced in the U.S. tax code to tax the U.S. taxpayer’s share of... Read more

Why should you choose a CPA firm that is growth-oriented?

In this vlog, Peter Harper, managing director and CEO of Asena Advisors, introduces us to Steve Martini, a partner of the firm... Read more

Stakeholder framework to corporate taxation

In our last video, Peter Harper introduced you to one of his partners Steve Martini of MAP international. Today Peter talks to... Read more

International Estate Planning: Issues with Jointly Held Assets

A “U.S. person” (citizen or green card holder) is subject to estate and gift taxes on their worldwide assets – i.e. regardless of... Read more

Decedent’s Domicile

The concept of “domicile” is critical in determining U.S. estate tax liability upon a decedent’s death since property located outside of the U.S.... Read more