Woodpoint Letter (Q1 2020): Correction or recession?

Market volatility reminds investors to understand risk

In our last investment letter, we examined the macro environment moving into 2020 and discussed key factors that investors should consider in a changing business cycle. We also debated the likelihood of a global recession in the wake of an inverted yield curve and the outlook for various asset classes.

Since then, there have been some significant developments including supply and demand shocks driven by the coronavirus (COVID-19), oil prices selling off and a spike in volatility across most global financial markets. In this investment letter, we will continue to assess the market cycle and explore the leading indicators useful in forecasting recession. This includes an in-depth review of private markets in this evolving environment.

At WoodPoint Capital, we aim to realize potential in private markets by financing and developing sustainable companies, sought-after real estate, and essential infrastructure. Understanding the risk of recession is crucially important to help us deliver a stable income profile and growing asset base to our investors. Despite concerns that a bear market is upon us, which could mean the potential deterioration of public market valuations, private investments with strong asset backing and high cash flow can be resilient through the cycle.

The economy is considered in recession after two consecutive quarters of negative GDP growth, and as such there is talk of the global economy already being in a ‘technical recession’. GDP is a lagging indicator, however financial markets typically move 12-18 months ahead of economic data. So, what should we be watching?

Two of the biggest challenges in fighting a recession are: (a) knowing when you’re in one; and, (b) deciding what to do next. Let’s take a look at the current recession signals, before turning to investment options in the current environment.

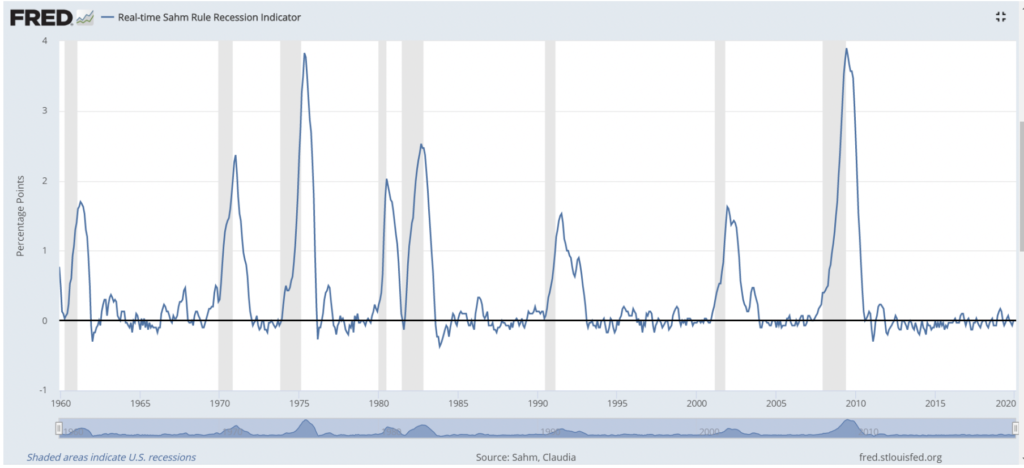

Timing a recession in real time: The Sahm Rule

One of the recessionary signals that economists usually look to is the unemployment rate, based on the fact that the unemployment rate has risen steeply during each previous recession.

A Federal Reserve economist has developed a simple formula to determine the beginning of a recession, known as the ‘Sahm Rule’. If the three-month moving average of the national unemployment rate rises a half-percentage point or more above its low point over the previous year, the economy is likely in a recession.

Source: Federal Reserve Bank of St Louis

The formula is employed to assist the timing of fiscal policy decisions in response to deteriorating economic conditions. This is particularly meaningful at a time when the Federal Reserve may be handicapped, with rates already near zero.

The formula would have accurately called every recession since 1970 within two to four months of when it started.

For the time being, the Sahm Rule indicates that the economy is slowing but not yet in recession.

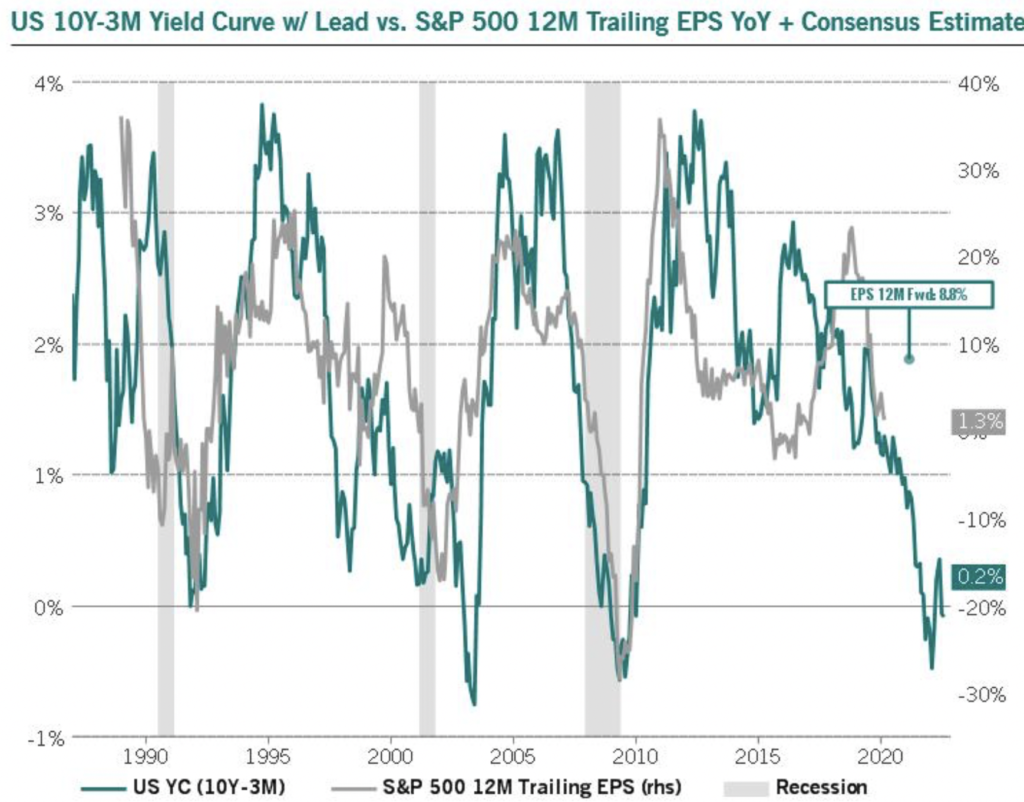

What can debt markets tell us?

What are financial markets telling us that job data may not be (yet)? Investors often look to debt markets for insight, specifically using the yield curve.

Historically, an inverted yield curve has been viewed as an indicator of a pending economic recession. When short-term interest rates exceed long-term rates, market sentiment suggests that the long-term outlook is poor and that the yields offered by long-term fixed income will continue to fall. This recession signal was flashing last year, although the curve quickly normalized following successive Fed rate cuts. The 10yr-2yr Treasury spread is currently +0.26%.

A yield-curve inversion has preceded every US recession since 1950 because of its very practical application. The yield curve has a real-world impact on the banking system. Tighter lending conditions are rarely positive for the economy. There’s also a market feedback loop, which can prevent decision-making by executives and discourage new investments.

10-2 Year Treasury Yield Spread: +0.26% (as at March 10, 2020)

While the Federal Reserve has been quick to cut rates following the COVID-19 outbreak, the “whatever it takes” approach may not be enough to restore economic activity. A coronavirus pandemic is causing a supply shock, although it is expected to be temporary, unlike, for instance, an increase in energy prices. A COVID-19 pandemic will likely have adverse effects on imports of raw materials, other intermediate materials and capital goods, reducing productivity and earnings. The actual cost of financial disruption will be difficult, if not impossible, to accurately estimate and may not even be a possibility for many months or years. Targeted fiscal policy as well as broader monetary policy may be required to have meaningful impact.

Keeping an eye on corporate earnings

The US yield curve also typically leads the earnings cycle by approximately 12 months. Pictet Asset Management suggests that consensus estimates will need to be reduced significantly following business disruptions from COVID-19.

Source: Pictet Asset Management

It’s important for investors to remember that the benchmark index S&P 500 gained approximately 30% in 2019. Curiously, however, the market also finished the year having pushed another indicator into recession territory.

Research from FactSet explains that S&P 500 companies experienced -2% fourth quarter earnings declines from the prior-year period. This followed year-over-year earnings per share declines in Q1, Q2, and Q3. The last time investors witnessed a four-quarter stretch of earnings stagnation in the S&P 500, the benchmark index underwent two corrections and essentially remained flat for the year.

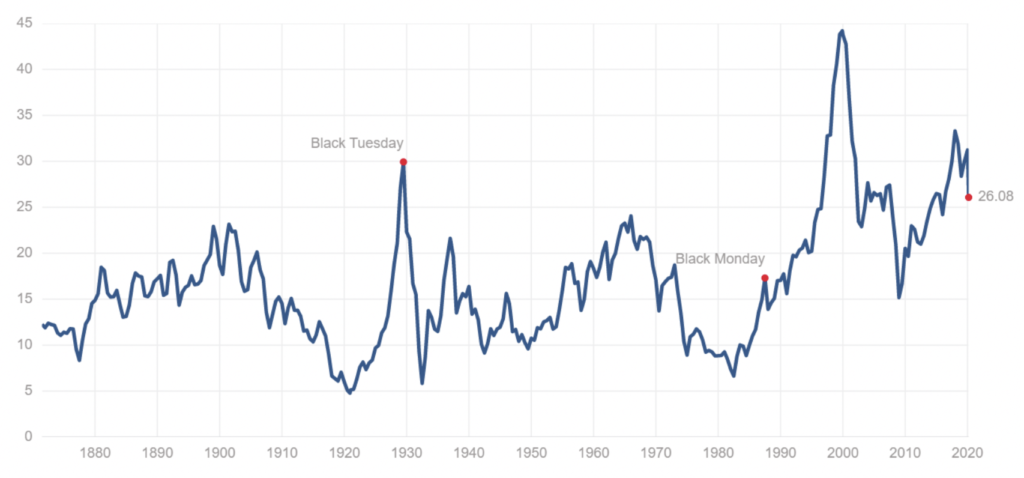

Has the recent sell-off improved valuations in public markets?

Turning now to options in the current market, the obvious question is whether the sell down in public markets has created investment opportunities.

The S&P 500 Shiller CAPE Ratio is defined as the S&P500’s current price divided by the 10-year moving average of inflation-adjusted earnings. It is a commonly used equity market valuation metric. At the start of 2020, according to the measure, equities were significantly overvalued. After the recent sell-off, equities continue to be overvalued.

Source: Multpl

At its current reading of 26.03, it will take 26.03 years of earnings for the S&P500 to repay investors their initial investment. This current valuation suggests that investors deploying capital today will receive an annual return of -0.10% p.a. for the next ten years.

Shiller P/E: 26.03

Shiller P/E is 54.8% higher than the historical mean of 17

Implied 10-year future annual return: -0.1%pa

Recession won’t change many investors’ insatiable search for yield, but it may change the availability of quality yield. Low rates may go lower, and volatility could become more prevalent in risk assets. Some investors may fail to meet their return objectives if they cannot find a source of stable cash-flow. Private markets can deliver a stable source of yield, particularly for opportunities providing essential services backed by long-term contracts or offtake agreements.

Private markets; risks and opportunities

As described in our last investment letter, we have been mindful of a recession for some time. We believe that recent market events will not result in a financial crisis. Rather, a serious price correction (at the time of writing this, the S&P500 has officially entered bear market territory), and investors should expect ongoing volatility and a global economic slowdown. It is important for investors to remain focused on their investment strategy. We believe our thesis which focuses on essential services and essential infrastructure in private markets will prove successful throughout this period. Private equity portfolios can diversify investors’ equity allocation when constructed properly. We believe that the fundamental differences in the private and public equity investment models will remain, implying that the diversification benefits of investing in private equity will persist in the future.

Private markets offer a number of significant advantages, including opportunities for operational and financial improvements, and often specialized experience which can provide competitive advantages.

Private equity can offer capital growth, yet in an environment of high valuation, it is important for investors to remain disciplined in their investment selection. Valuations remain high from a historical basis, with EV to EBITDA multiples of buyouts in the US at an all-time high of 10.6x, being two standard deviations above long-term averages.

In the current environment, real assets and infrastructure can be a strong source of reliable cashflow for the right projects. The US has significant capital gaps from aging, underserved and underfunded infrastructure assets. There is a need to create value through construction, capital improvement and/or de-risking assets. In this regard, we also see opportunity for value add in various operating real estate sectors. Cap rates in the US for core assets were roughly 4.5% in 2019. As the real estate cycle matures, it will be important to work with operators who can drive earnings in these assets and take advantage of special situations.

WoodPoint aims to provide investors sustainable long-term value by targeting investments in essential services and essential infrastructure. We are broadly sector-agnostic, although we have a strong preference for non-discretionary opportunities which will be resilient through an economic cycle.

*Most recent data at the time of writing (03/11/2020)

Disclaimer: The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from WoodPoint Capital LLC (“WPC”). This is not a solicitation of an offer to buy, you should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances. WPC is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.