Digesting Alphabet Soup: How Should Investors Navigate The Recovery?

Many investors have been left baffled over the last few weeks, as seemingly negative news caused by the COVID crisis has somehow pushed equity markets higher. It appears as though economic data and company earnings have completely decoupled from stock prices.

There are plenty of signals that the economy is struggling. For instance, according to the US Bureau of Labor Statistics, unemployment has reached 14.7% with the economy shedding 20.5 million jobs in April. Meanwhile, GDP shrank by an annualized -4.8 percent in the first quarter of 2020.

However, these alarming indicators come as equities rally to exceed their 2019 levels, reflecting valuations 16x 2021 consensus earnings. Do aggressive government stimulus, cheap oil and low interest rates justify these levels?

In this paper we explore what may be required for the economy to achieve what the stock market is pricing in, and how investors can position themselves to make the most of the crisis.

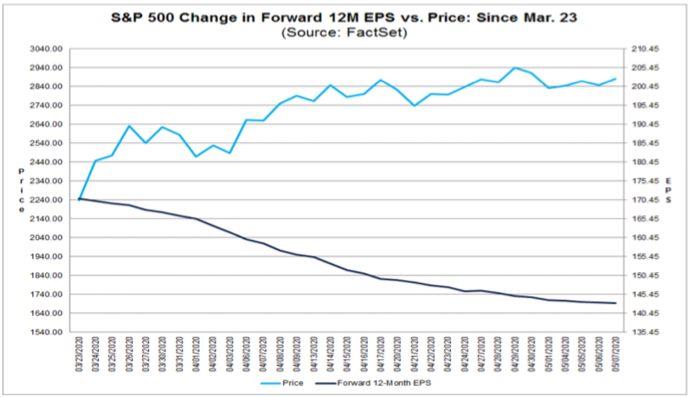

Did you know? Since March 23, $SPX forward 12M EPS has declined by 16.2% while $SPX price has increased by 28.8%.

Sickly or surging: How will the market recover from its COVID ailments?

There are three main assumptions implicit in the market recovery:

1. Infection second waves, if they occur, will not overburden healthcare systems to the point that governors reimpose lockdowns.

2. If lockdowns persist, additional Federal and state assistance will be forthcoming to offset household incomes and delinquency rates.

3. The employment and consumer spending “elasticity” to reopening will be high

Understanding the consumer will be critical in navigating the recovery. GDP is the standard macroeconomic measure of overall economic health, but recessions are felt at the household level. Household solvency (i.e., whether monthly income meets monthly obligations) drives recessionary ripple effects.

Some light amidst the darkness: the consumer perspective

Encouragingly, consumers are starting from a strong position:

Delinquency rates are at record lows.

Levels of home equity soared to all-time highs of $6.3 trillion in mid-2019, which is 25% higher than the 2006 peak.

The current low-interest rate environment eases debt service, such that income required for household solvency is even less.

Did you know? Consumer debt as a portion of household income has decreased 27% since the 2007-2009 financial crisis.[1]

| 2009 | 2018 | |

| Average Income | $38,213 | $50,413 |

| Average Total Debt | $94,442 | $90,460 |

The amount of government relief has been greater and delivered much faster than prior recessions, which has had a meaningful impact on household solvency. In fact, the CARES Act provides weekly unemployment benefits that are 156% greater than the nationwide average[2].

Some US workers will earn more in unemployment benefits then they did in their jobs pre-COVID-19.

Finally, consumers are also behaving more conservatively than in previous recessions, decreasing spending on everyday expenses, and spending record-low amounts on discretionary items. Such a significant change in spending is akin to forced savings by consumers.

| Motor Vehicles & Parts (-33.2%) | Restaurants & Bars (-60%) |

| Food Services (-29.7%) | Airlines (-92.1%) |

| Transportation (-29.2%) | Hotels (-84.8%)[3] |

But will US consumers spend once states reopen?

JP Morgan has been tracking the impact on consumer spending using information provided by Chase Card Services. As shown in the chart below, there are already signs of a revived economic pulse at a national level.

Volatility in the equity markets: passive exposure an unnecessary risk?

It is encouraging to see that US consumers are well positioned. Coupled with strong policy response and a banking system with high capital buffers, we may avoid the ‘L’ shaped recovery or deep depression proposed by some commentators.

Amid the competing efforts to predict the shape of the recovery, our view is that growth will pick up in 2021 following a gradual reopening of the economy in the second half of 2020.

In the meantime, we will likely experience high levels of volatility across markets, with more near-term risk to the downside for equity markets. Investors may choose to maintain high levels of liquidity as S&P 500 valuations remain elevated.

Shiller P/E: 26.6

Shiller P/E is 56.5% higher than the historical mean of 17

Implied 10-year future annual return: 0.3%

Source: Multpl, 2020

Unsurprisingly, S&P 500 valuations and corporate earnings vary widely across sectors. To date job losses have been highly concentrated in travel and hospitality. Earnings consequences are concentrated as well. Earnings for Tech, Internet Retail and Media are expected to hold up better than other sectors. The damage seems focused in cyclicals and financials, which represent almost a third of S&P 500.

How will private markets perform in a recession?

Market dislocations present interesting challenges and opportunities for investors. As private market investors, we believe that investing in essential services, supported by sustainable cashflows and quality asset backing, will provide superior returns, particularly during a difficult operating environment.

Historical data shows that private equity’s outperformance actually increases during distressed periods. Recent reports by Cliffwater[4], which examined long-term private equity investment programs, showed private equity returns were most noticeable during downturns, outperforming public markets considerably.

At WoodPoint Capital, we have targeted “COVID-agnostic” opportunities, working with operators whose business models are either well immunized from disruption, or well placed to rebound strongly in the recovery. Certain operating real estate assets have performed well, including data centers, cell towers and storage, to name a few. Demand has remained firm in these sectors and long-term contracts provide strong visibility on earnings. In particular, we are interested in opportunities with Tier 1 counterparties and proven operators who can deliver against short-term business plans.

We’ve also been focused on various secondary market opportunities; providing liquidity to unlock value. One additional upside of the recent market volatility is that pricing levels in the secondary market are expected to potentially adjust downward, leading to a more attractive buying opportunity for secondary investors. This enables discounted access to private equity funds paired with shorter duration and faster return of capital.

Considerable macro risk will remain until an effective vaccine is developed. For investors keen not to waste this crisis, private markets can provide an opportunity to capture meaningful growth, while protecting capital. We believe that by investing in essential services and essential infrastructure, which secures exposure to stable and growing cashflows, complemented by a high-quality asset base, we can unlock significant opportunities for investors.

[1] Experian, “Debt reaches new highs in 2019 but credit stays strong”, 2020

[2] Wall Street Journal, “Coronavirus Relief Often Pays Workers More Than Work”, 2020

[3] Annualized decline as at 4/4/20 vs 4/4/2019 Verisk Financial, “Consumer Spending Data by Industry”, 2020

[4] Cliffwater, “An Examination of Private Equity Performance among State Pensions, 2002-2017,” updated May 2018.