Restructuring your US operations – Part 1: why, and how you would convert an LLC to an Inc.

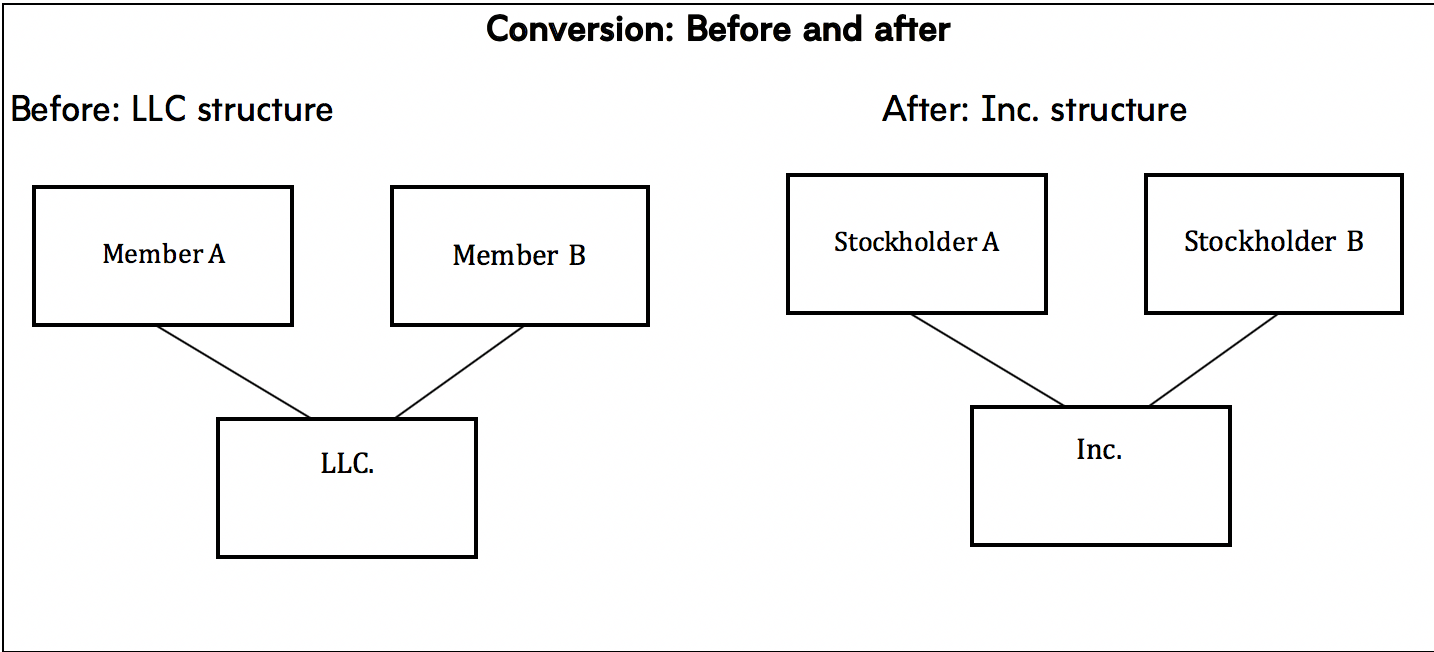

Many Australian business owners often fund their initial expansion into the US market through a limited liability corporation or “LLC”. An LLC is a business structure that provides the limited liability of a corporation, with “pass-through” taxation. A single member LLC is essentially treated as a sole proprietorship, and if there are two of more members, the LLC is treated as a partnership for tax purposes.

After an initial start-up phase, business owners often consider converting the LLC to an “Inc.” or “C corporation” to attract investors through the issue of stock or to offer employees stock options, neither of which can be done through the LLC structure. The conversion may also be part of a broader restructure of the US operations (see Restructuring your US operations – Part 2: US corporate reorganization relief and Restructuring your US operations – Part 3: Anti-avoidance rules in the Internal Revenue Code).

A conversion does have its drawbacks, especially as it results in a change to the underlying tax structure. Only members are taxed in an LLC structure. However, with a C corporation, there are two levels of taxation – first, at the corporate level, and then at the stock holder level, with the “dividend received deduction” only available to other C corporations, with the deduction percentage varying accordingly to the ownership percentage.

The process of conversion can also be complex depending on the State in which the LLC was formed, and whether the Inc. is to be formed in a different State. For example, consider an LLC formed in Delaware (a State which offers tax benefits and an established body of corporate law) which is to be converted to a California Inc. The Delaware LLC would be a “foreign other business entity” for conversion purposes under the California Corporations Code, as it is a business entity organized under the laws of another State. Under California law, it can only convert to a California corporation if the conversion is permitted under Delaware law. As the Delaware Corporations Code allows a Delaware LLC to convert to a Delaware Inc. a Delaware LLC can convert to a California Inc.

There are a number of ways of undertaking a conversion, with simplest form of conversion being an “assets-over” (“statutory”) conversion, with:

1. the LLC transferring all of its assets and liabilities to the Inc. in exchange for all of the stock in the Inc.; and

2. the LLC distributing all of the Inc. stock to the LLC members and terminating.

Certain procedural aspects of conversion also need to be complied with, including:

1. filing new articles of incorporation – i.e. registering the Inc.;

2. obtaining a new EIN (“employer identification number”) from the IRS

3. creating “corporate bylaws” for the Inc. – i.e. this is essentially the corporate constitution

for the Inc.

4. electing directors and officers;

5. scheduling meetings of board members and shareholders;

6. issuing stock certificates; and

7. the LLC partners filing a “short tax year” return and paying any outstanding tax liabilities to the IRS within three and a half months of conversion.

A conversion would qualify for tax relief in the US with no gain or loss being recognized to the transferors, if (under the Internal Revenue Code section 351):

1. the property is exchanged only for “qualified” stock (i.e. stock that cannot be redeemed or bought back by the issuer and for which the dividend rate can vary);

2. all of the transferor’s rights to make, use, and sell the property are conveyed to the Inc.; and

3. immediately after the exchange, the transferors are in “control” of the Inc, holding 80% or more of the stock and total combined voting power of all classes of stock.

If the LLC has liabilities in excess of its tax basis in its assets, the LLC’s owners may recognize income on the conversion to the extent that the liabilities exceed the tax basis.

The concepts discussed in this blog are complex and require careful consideration to ensure compliance with Australian and US tax laws.

This blog is part of a 3 part series comprising:

Restructuring your US operations – Part 1: why, and how you would convert an LLC to an Inc.

Restructuring your US operations – Part 2: US corporate reorganization relief

Restructuring your US operations – Part 3: Anti-avoidance rules in the Internal Revenue Code

For more information, contact:

Renuka Somers

Senior Tax Advisor

U.S. Australia Tax Desk