Woodpoint Capital: 2020 Investment Letter

The recession debate:

A recession occurs on average every seven years. But in the US, the bull market is roaring into its 11th consecutive year. Are we overdue for a downtown, or can the bull market continue its momentum?

In this investment letter, we examine the current macro environment and discuss key factors that investors should consider in a changing business cycle. This includes a review of fixed income and public equity markets, private equity, real estate and real assets. At WoodPoint Capital, we aim to realize potential in private markets by financing and developing great companies, sought-after real estate and essential infrastructure. Understanding the risk of recession is crucially important to help us deliver a stable income profile and growing asset base to our investors.

Mixed signals: The significance of the un-inverted yield curve:

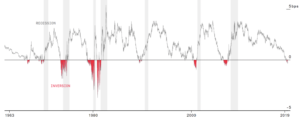

Many investors look to the yield curve as an indicator of impending recession. An inverted yield curve occurs when long-term interest rates are lower than short-term interest rates. Under these circumstances, companies can find it more expensive to fund their operations, and executives tend to moderate or defer investments. Consumer borrowing costs also rise and consumer spending slows. The inverted yield curve has consistently predicted every recession in the past five decades.

Most look at the inversion as the signal, but in reality, the inversion is the ‘amber light’. The subsequent steepening of the curve, coupled with other key indicators, generally confirm that recession is around the corner. In August 2019, the yield curve briefly inverted. The Fed has since walked back on planned interest rate increases and bond markets have begun to normalize. This is causing tightening that has translated into the yield curve steepening. Despite this, equity markets have continued to rally, whilst at the same time, regional Fed Surveys, the OECD LEI and other indicators are still falling. Some market participants claim that the combination of easing monetary policy and lower taxes in the US justify a continued bull run. Others say that equity investors don’t appreciate the real and meaningful risk of potential recession.

Item 1: The yield curve over the past five decades

Sources: Bloomberg data, NBER

Low profit margins, high chance of recession:

Looking beyond the rates markets, corporate profit margins are also indicative of the ebbs and flows of the broader business cycle. Narrowing corporate profit margins often lead to declines in capital investment and hiring. This can potentially result in higher unemployment, lower consumer spending, decelerating economic growth – and ultimately, recession.

U.S. corporate profit margins are in the midst of sharp declines. The potential for further margin compression and downward earnings revisions are risks for equities.

Item 2: U.S. corporate profits over the business cycle, 1965-2019

Sources: BlackRock Investment Institute, with data from the U.S. Bureau of Economic Analysis (BEA), U.S. National Bureau of Economic Research (NBER) and Refinitiv, December 2019

Margin deterioration should be taken seriously. It is often a precursor to layoffs and ultimately recession. Companies often cut labor expense in order to preserve earnings growth. However, the statistics are bucking the trend, and this scenario doesn’t seem to be playing through to the US labor market, which remains resilient, reflected in strong jobs data. The unemployment rate fell to 3.5% in September, its lowest rate since 1969.

It should strike investors as curious that markets appear to have dismissed the earnings recession which has been building during the year. An earnings recession is defined as two quarters or more of consecutive year-over-year declines. At the time of writing, earnings of the S&P500 are expected to decline year-over-year in all four quarters of 2019. “Earnings in the S&P 500 index are now projected to decline 1.51% in the fourth quarter from the year before,” according to FactSet.

Recession indicators

– Yield Curve (10/2 spread) = 0.29

– Unemployment rate = 3.50%

– US Corporate Profit QoQ = -4.10%

It is important to note, however, that these declining earnings are primarily focused in energy, consumer discretionary and material sectors. Some sectors are showing strong profit growth for the year, including communication services, financials, real estate and utilities.

Is there value in the equities market?

We all know the old adage that investment returns are determined when you buy, not when you sell. This highlights the importance of buying well, which requires an understanding of valuation. One of the bell-weather metrics for valuing equities is the Shiller CAPE ratio. The S&P 500 Shiller CAPE Ratio, also known as the Cyclically Adjusted Price-Earnings ratio, is defined as the ratio the S&P500’s current price divided by the 10-year moving average of inflation-adjusted earnings.

Item 3: S&P500 Shiller CAPE Ratio

Source: Multpl

At its current reading of 30.88, it will take 30.88 years of earnings for the S&P500 to repay investors their initial investment – longer than a mortgage! Needless to say, the current Shiller P/E implies that US equities are currently overvalued. This current valuation suggests that investors deploying capital today will receive an annual return of -2.10% p.a. for the next ten years.

An overvalued equities market

Shiller P/E: 30.88%

Shiller P/E is 78% higher than the historical mean of 17

Implied future annual return: -2.10%

However, despite these gloomy indicators, many market commentators have highlighted the shortcomings of the Shiller PE, suggesting that as rates are held low, equities are reasonably priced, particularly on a relative basis. As discussed earlier, investors should closely monitor both movements in interest rates and corporate earnings, although equity markets have a habit of reminding us about how mean reversion works.

What can private markets tell us?

WoodPoint Capital is particularly interested in valuation in private markets. Interestingly, some private market valuations have become even more expensive than public markets. 2019 may be best remembered for the failed IPO of many high-profile firms. Public markets could not justify the carrying value of these private companies.

It is particularly important to note that the economy moved into recession after the previous two periods when private market valuations exceeded public.

Is a recession just around the corner?

So, are we bulls or are we bears? Although we don’t believe a recession is imminent, we do believe that we have entered the late stage of this economic cycle. We will continue to be selective on the sectors and assets which we pursue.

“After the previous two periods when private market valuations exceeded public, the economy moved into recession.”

What next for private markets? We are positive, but selective, on private assets, given the current market outlook. We believe our philosophy of investing in essential services, underpinned by quality earnings and tangible assets will deliver superior returns in a low-rate, low-growth environment. US operational real estate looks particularly compelling, and has historically offered resilience against inflation. In particular, we are interested in real estate opportunities which can be structured with low levels of debt, and which can deliver against a short-term business plan. We believe that if we can secure exposure to stable and growing cashflows supported by a high-quality asset base, we will achieve the right outcome for investors, even through a difficult operating environment.

*Most recent data at the time of writing (12/23/2019)

Disclaimer: The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from WoodPoint Capital LLC (“WPC”). You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances. WPC is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.