Stage Five Clinger: How the TCJA Latches onto Unassuming Foreign Persons through Constructive Ownership

In our whitepaper, The Expansion of “United States” Taxpayers: How the TCJA Drags Unassuming Foreign Companies and Individuals under its Scope, we discuss the how the Tax Cut and Jobs Act of 2017 significantly expands the number of shares a U.S. Shareholder may be deemed as owning for purposes of determining whether a foreign corporation is a CFC. In our last few blog posts, we introduced the three types of ownership (direct, indirect, and constructive), as well as the three types of attribution that give rise to constructive ownership (family attribution, upward attribution, and downward attribution). These concepts can be hard to grasp so we wanted to provide an example illustrating the interaction of all of these rules in determining whether a foreign corporation is a CFC.

Part One: The Original </3>

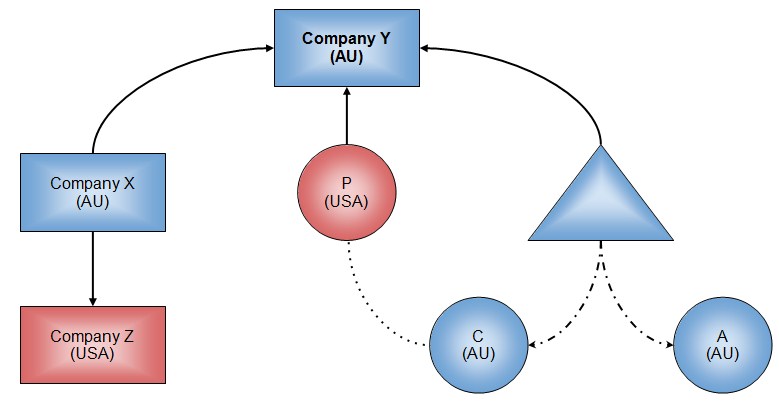

In the following diagram, we are trying to determine whether Y is a CFC. Most of the diagram is self-explanatory, but there are a few items to note. First, the only U.S. Persons are P and Z, and every other individual/entity is a U.S. nonresident alien. Secondly, P is C’s parent and C is P’s child. Lastly, C and A are the only two beneficiaries of T, so they have equal shares.

Under the TCJA, Y will be classified as a CFC for U.S. tax purposes if at least 50% of the shares are owned by or controlled by U.S. Shareholders, either directly, indirectly or constructively.

Analysis of Direct Ownership

P is the only U.S. Person to directly own shares in Y, and P is a U.S. Shareholder because P owns at least 10% of Y’s total value. So, a U.S. Shareholder directly owns 20% of Y.

Analysis of Indirect Ownership

In this scenario we do not have any indirect ownership. While T is holding the shares on behalf of C and A, all of them are nonresident aliens.

Analysis of Constructive Ownership

Remember that there are three ways constructive ownership arises, either by family attribution, upward attribution, or downward attribution. Under family attribution, parent and child are deemed as constructively owning each others shares. However, where one family member is a nonresident alien then they are excluded from this attribution. P and C have a parent-child relationship so normally they would be treated as constructively owning each other’s shares, however because C is a nonresident alien, they will not be.

T is holding 20% of the shares in Y for the benefit of its beneficiaries, C and A. Under upward attribution, C and A will be treated as indirectly owning their pro rata share of T’s interest in Y. In other words, C and A both indirectly own 10% of Y.

X holds 20% of the shares of Y and owns 100% of the shares in Z. Under the downward attribution rules, Z is accordingly treated as owning X’s 20% interest in Y.

Analysis of CFC Status Under First Diagram

Under this diagram, U.S. Shareholders directly own 20% of Y and constructively own another 20%. This equals to 40% ownership of Y by U.S. Shareholders. This is lower than the 50% threshold required by the Code, so Y will not be a CFC.

Part Two: Original with a Tweak

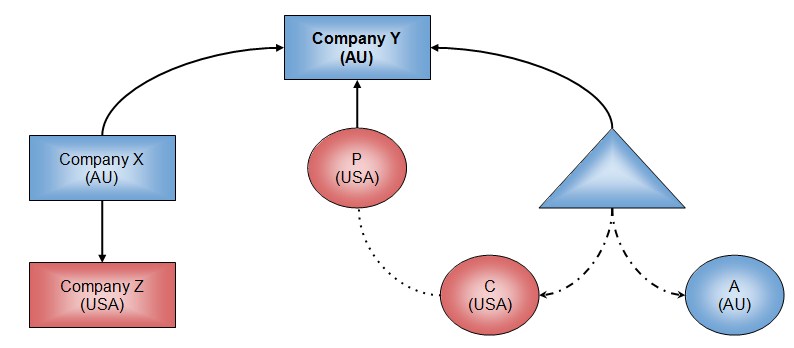

If C were a U.S. Person instead of a nonresident alien, then our analysis would change.

In particular, if C is a U.S. Person then the family attribution rules would become applicable, and P be treated as constructively owning C’s shares and vice versa. As we determined in Part one, C constructively owns 10% of Y through upward attribution. P would then constructively own this 10% through family attribution. Accordingly, U.S. Shareholders would directly own 20% and constructively own 30% of Y. This meets the 50% threshold, and as such, Y would then be a CFC and would need to comply with the U.S. tax obligations on CFCs.