Rules of POEM – Part II

An earlier blog on POEM started with a discussion on the determinants of residential status of a foreign corporation in India. The Indian tax law defines “place of effective management” as a place where key management and commercial decisions that are necessary for the conduct of business of an entity as a whole are, in substance made. But the Indian revenue department issued subsequent circulars to explain the determinants of the POEM.

For family offices and global enterprises with presence both in India and the US, the pressing issue is to determine the residence of their US or other foreign corporation in India. A strategic review of business structure can help the global entrepreneurs to focus on optimizing their resources towards their growth rather than reinvesting profits to add to their budgeting costs. The tax exposure for a foreign corporation, if determined as having residence in India, can be really high. The compliance costs to run can add as an item on your annual budgeting.

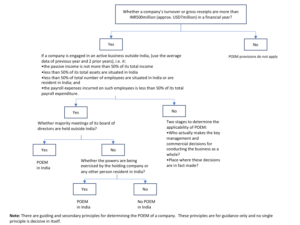

In guiding our readers to understand if there may be a possible exposure, we have prepared a flow chart on the Indian POEM analysis. As the POEM is to be applied based on fact on every case, this chart is a high-level understanding and it would be in the best interest of the reader to consult us if you would like to know more on the applicability of POEM to your business.