Are you Tax Compliant, and if not, what does this mean for Your Estate?

Did you know? Obtaining probate (i.e. the process of having a decedent’s Will recognized by the courts and the appointment of the executor or personal representative to administer the estate and distribute assets to beneficiaries) in the U.S. requires that the decedent has been compliant with all U.S. Federal and State individual and estate tax filing and reporting obligations.

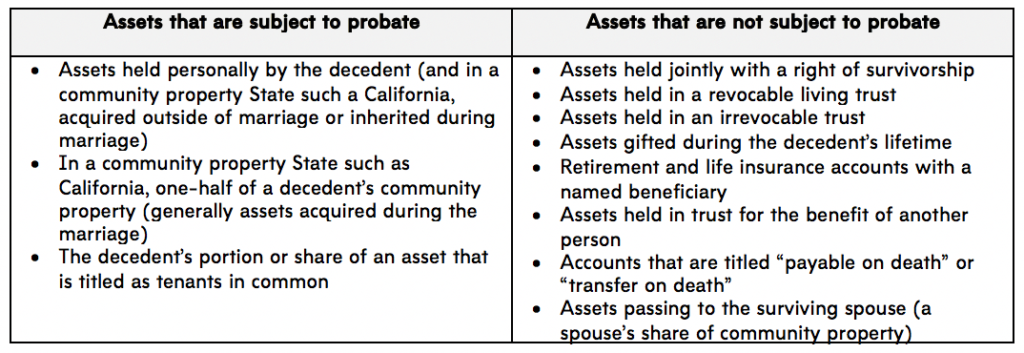

So, if you hold assets in the U.S. that are subject to probate upon your death (see table below), the probate process cannot be finalized and your estate closed until a tax clearance letter has been issued by the IRS. The tax clearance letter confirms that the federal estate tax return has been filed and accepted by the IRS. A State tax clearance letter may also be required if assets are held in that State.

Any delinquency with tax filings will, therefore, delay probate (and the distribution of your estate in accordance with the terms of the decedent’s Will), and could result in the imposition of tax penalties and interest (with tax debts ranking in priority over other debts) and, in turn, decrease the net estate distributable to your beneficiaries.

Our whitepaper International Estate Planning for U.S.-Australia cross-border clients provides an in-depth analysis of international estate planning issues.

If you have any questions, please contact:

Renuka Somers

Senior Tax Advisor

U.S. Australia Tax Desk