The Ground is Moving – Focus on What You Can Control!

There are 4 stages to the psychological impact of epidemics. As entrepreneurs we need to push the dialogue from panic and fear...Read more

Woodpoint Letter (Q1 2020): Correction or recession?

Market volatility reminds investors to understand risk In our last investment letter, we examined the macro environment moving into 2020 and discussed key...Read more

Restructuring your US operations – Part 3: Anti-avoidance rules in the Internal Revenue Code

Where a corporate reorganization results in a transfer of property to a foreign corporation (such as an Australian registered company), the normal nonrecognition...Read more

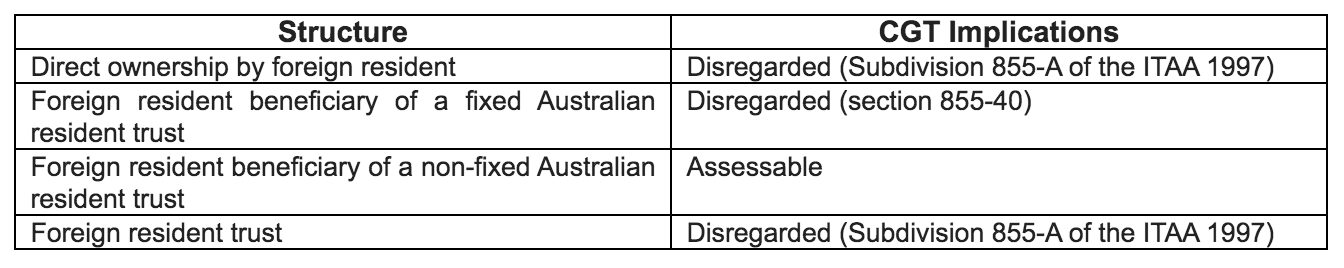

CGT and foreign resident beneficiaries: TD 2019/D6 and TD 2019/D7

The Australian Taxation Office recently released draft Taxation Determinations TD 2019/D6 and TD 2019/D7. The combined effect of the draft Determinations is that...Read more

The U.S. GILTI rules do not correspond to Australia’s CFC attribution rules for the purposes of the Australian hybrid mismatch rules: TD 2019/D12

The ATO has just released draft Tax Determination TD 2019/D12 in which it confirms that section 951A of the U.S. Internal Revenue Code...Read more